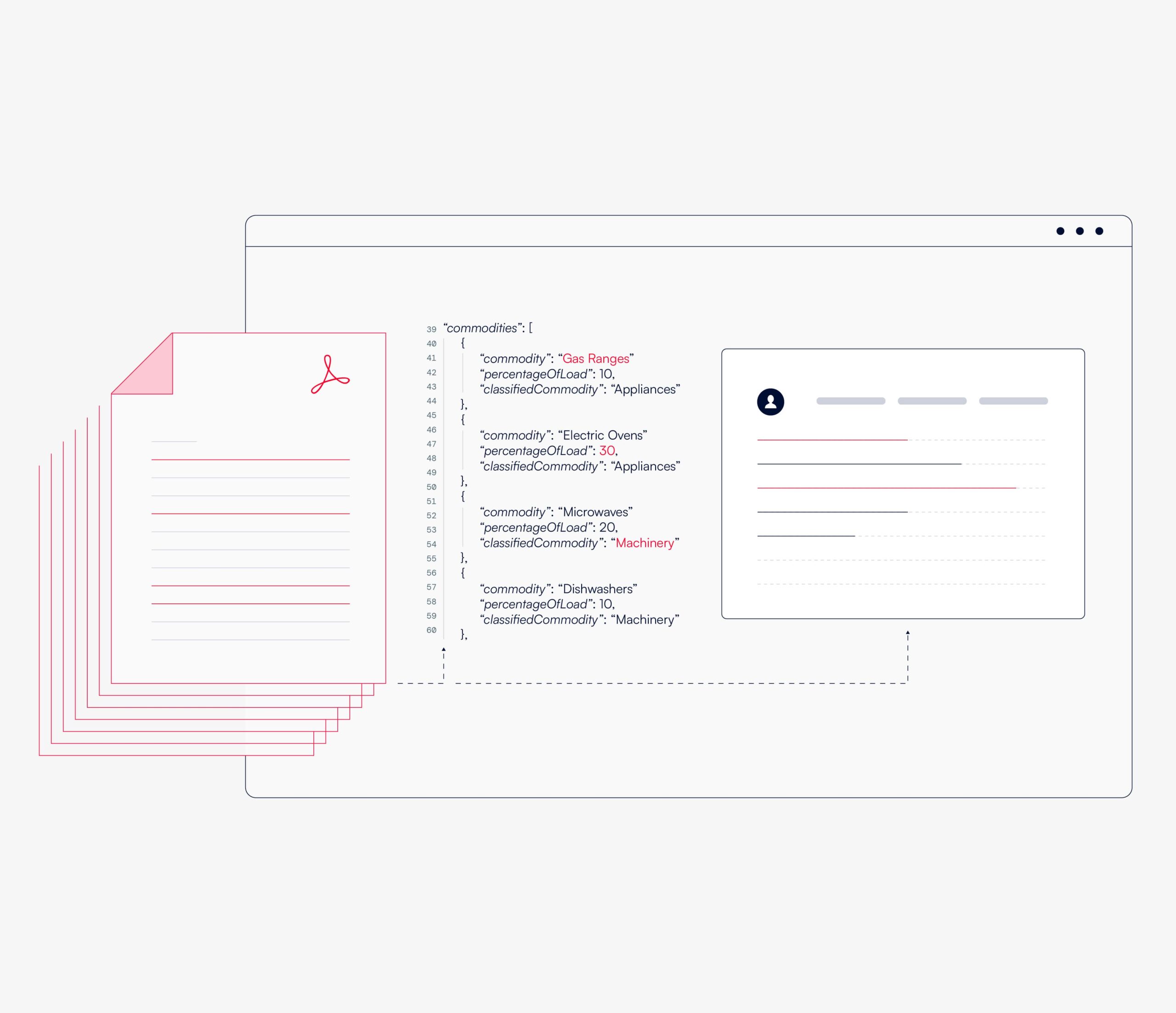

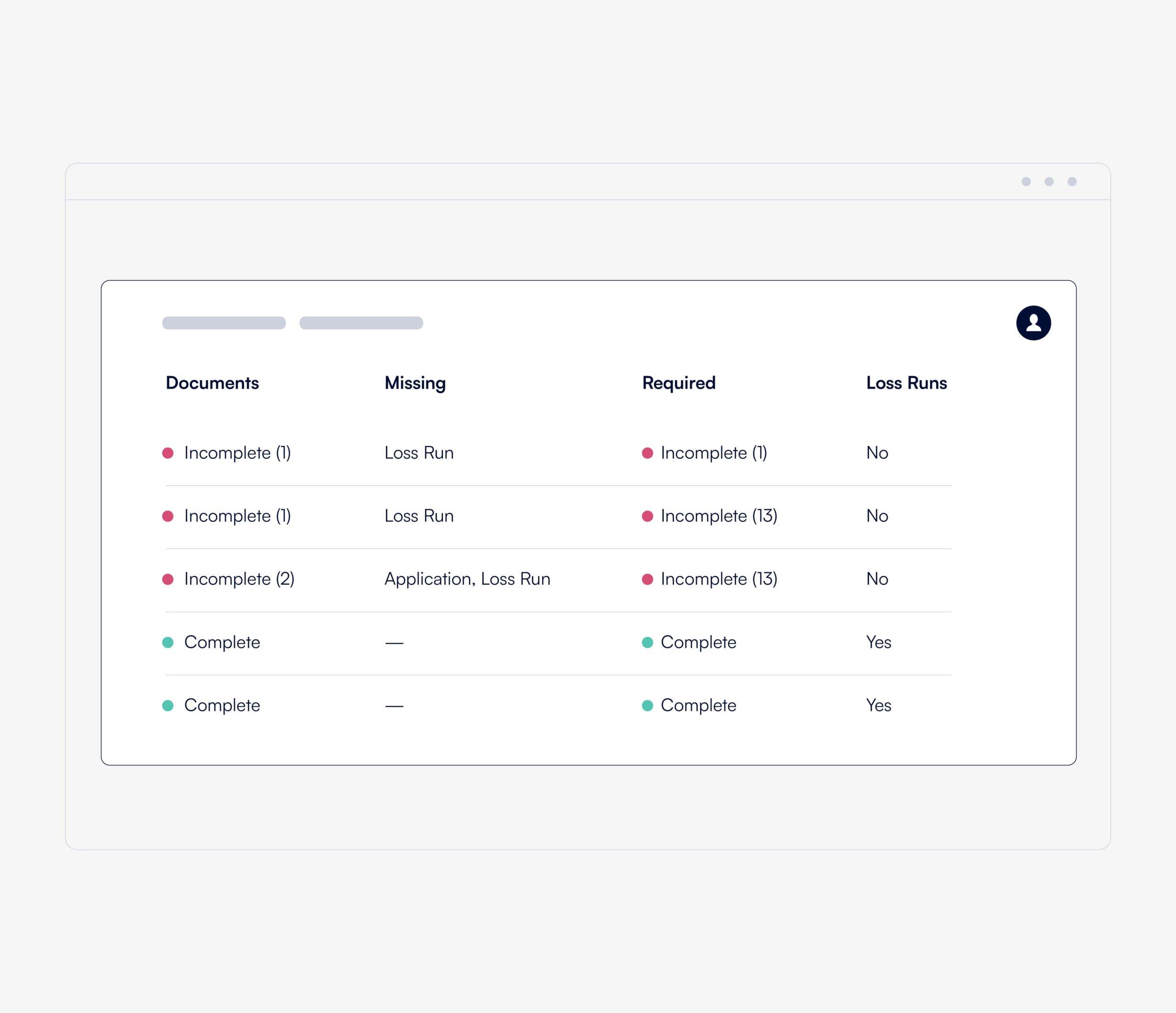

Trapped & Incomplete Data

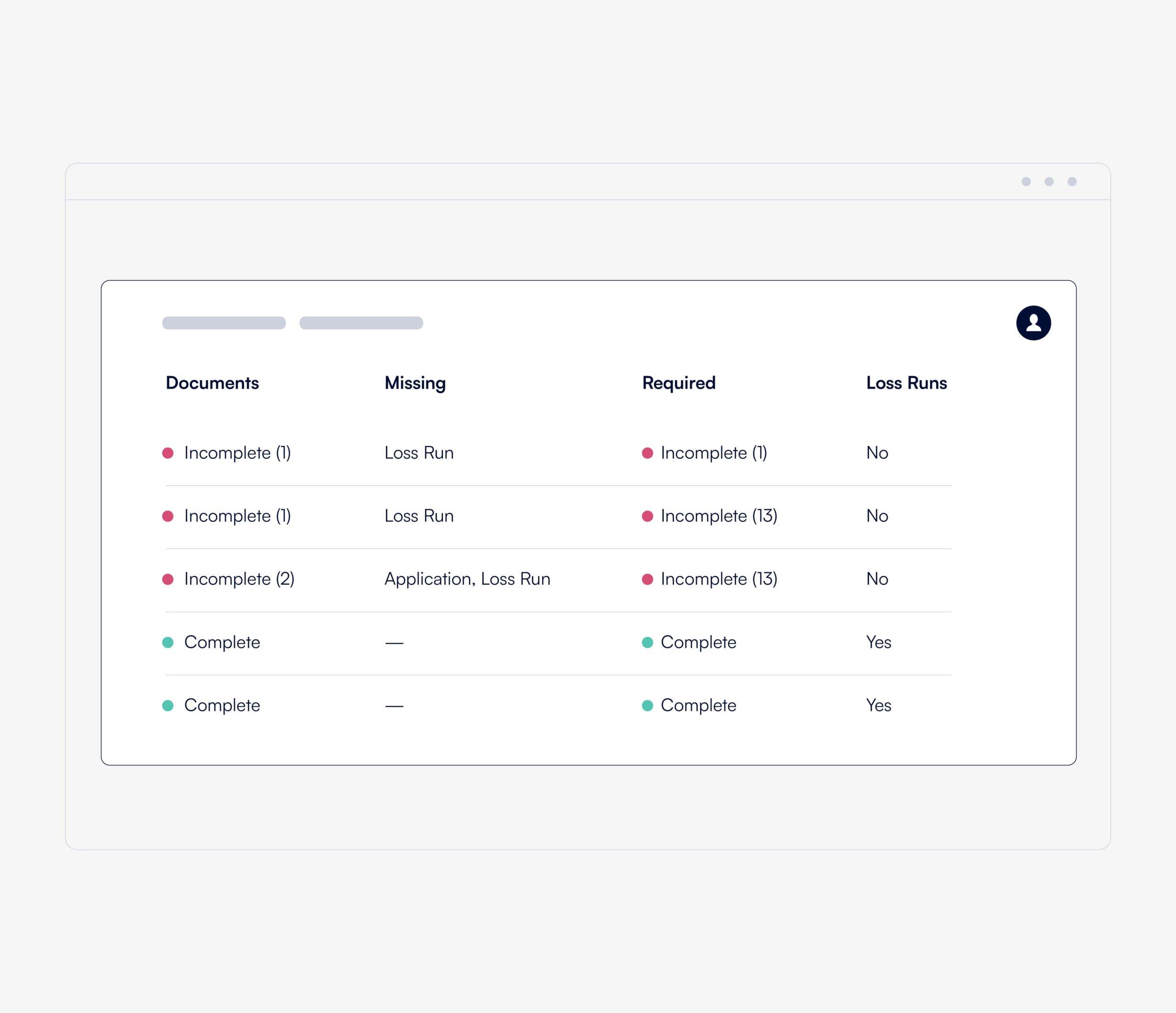

Slow, Cumbersome Processes

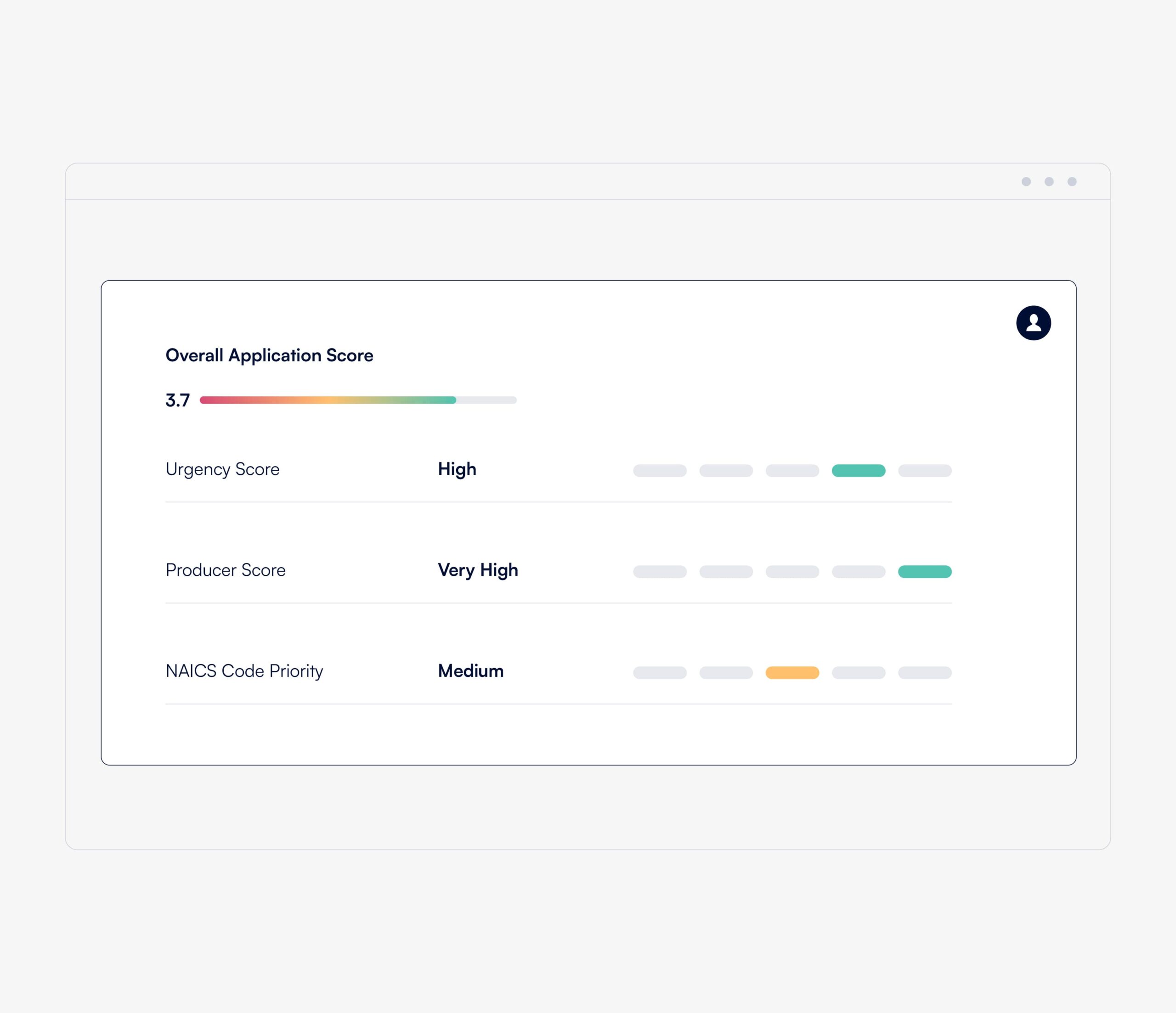

Profitability & Growth Constraints

Two Sigma Insurance Quantified, LP (“Insurance Quantified”) is affiliated with entities that offer investment management, advisory and related services. Insurance Quantified’s business is separate and the services it offers are different from the business and services of its affiliates. This website is not an offer to, or solicitation of, any potential clients or investors for the provision of investment management, advisory or any other related services. Insurance Quantified does not provide any insurance products, or sell or negotiate insurance products. Insurance Quantified does not provide any services to consumers.

Insurance Quantified is proud to be an equal opportunity workplace. We do not discriminate based upon race, religion, color, national origin, sex, sexual orientation, gender identity/expression, age, status as a protected veteran, status as an individual with a disability, or any other applicable legally protected characteristics. Links from this website to third-party websites do not imply any endorsement by the third party of this website or of the link nor do they imply any endorsement by Insurance Quantified of the third-party website or of the link.